The Gap in Mechanical Rules

Swing charts follow strict mechanical rules: wait for the required consecutive bars, then mark the reversal. This works beautifully most of the time.

But markets don't always cooperate with clean patterns.

Sometimes price will exceed a prior swing extreme — making a new high above the last swing high, or a new low below the last swing low — without printing the required consecutive bars to technically "confirm" the move. Strict mechanical rules would ignore this entirely, leaving a gap in your swing structure.

Gann identified this problem decades ago and codified a solution: the Exception Rule.

What the Exception Rule Does

When enabled, Gann's Exception Rule marks a swing when price exceeds a prior extreme, even if the consecutive bar requirement hasn't been fully met.

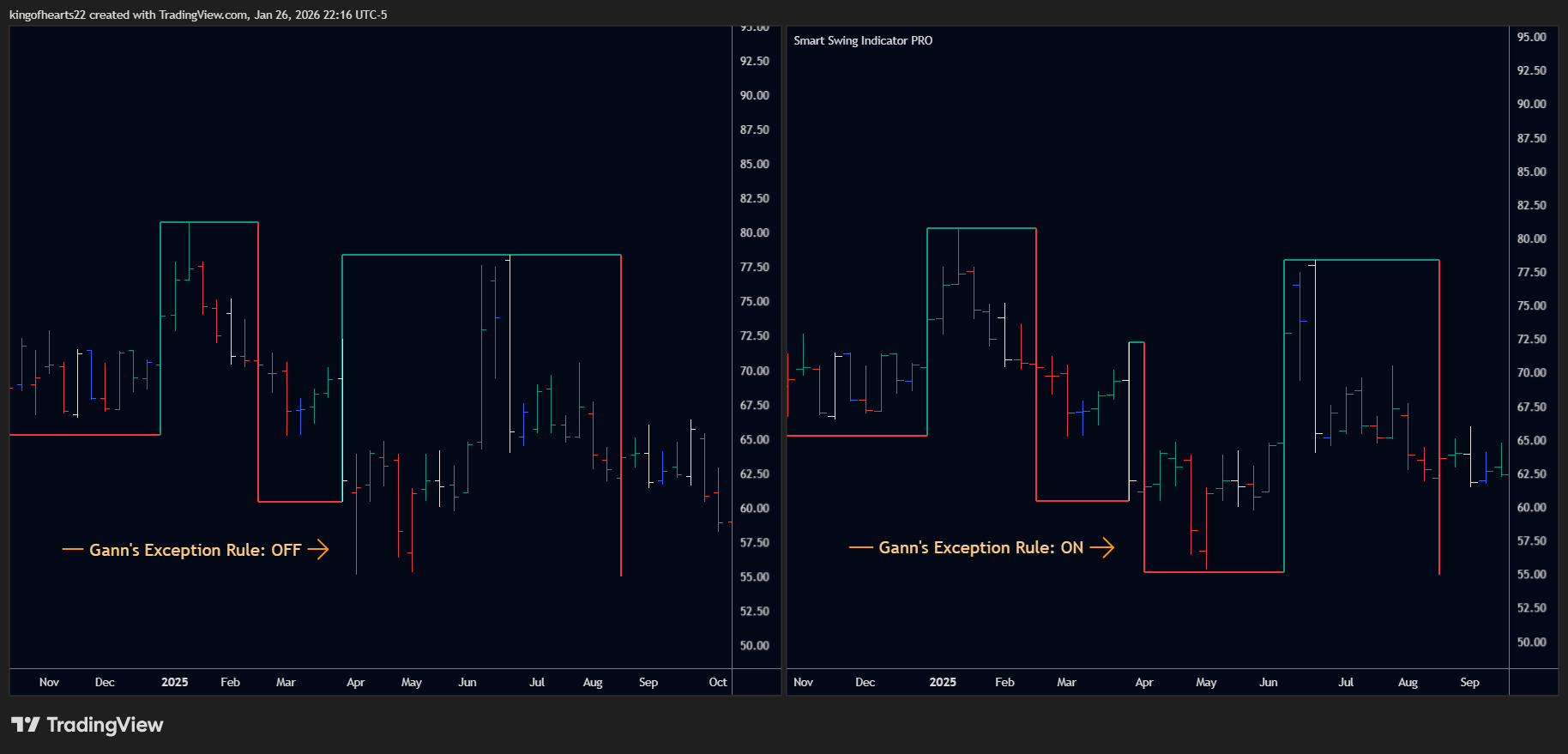

Standard behavior (Exception Rule OFF):

- Period 2 requires two consecutive bars to confirm reversal

- If price makes new high but only runs one bar up, no swing is marked

- The range is "invisible" to the swing chart

With Exception Rule ON:

- Period 2 still prefers two consecutive bars

- But if price exceeds the prior swing extreme, the swing extends to capture that range

- The complete price movement is recorded

Without the Exception Rule, this swing high would be invisible to the chart.

Without the Exception Rule, this swing high would be invisible to the chart.

The Historical Context

Gann developed swing charting in an era of hand-drawn charts and daily price records. His methodology evolved through decades of practical trading, not academic theory.

From his 1950 coursebook on 2-day and 3-day charts:

"If a market exceeds a three-day top or bottom but hasn't run for three consecutive up days or down days, you can still swing the chart down to include that range."

The Exception Rule isn't a compromise or workaround — it's part of the original methodology. Gann recognized that price making a new extreme is significant information, regardless of whether the consecutive bar count was technically satisfied.

When It Matters Most

The Exception Rule becomes increasingly important at higher swing periods.

Period 1: Rarely relevant. Every directional bar qualifies, so there's little room for "exceptions."

Period 2: Occasionally relevant. Markets sometimes spike to new extremes on single bars before continuing.

Period 3+: Frequently relevant. The higher the period requirement, the more likely price will exceed prior extremes without meeting the full consecutive bar count.

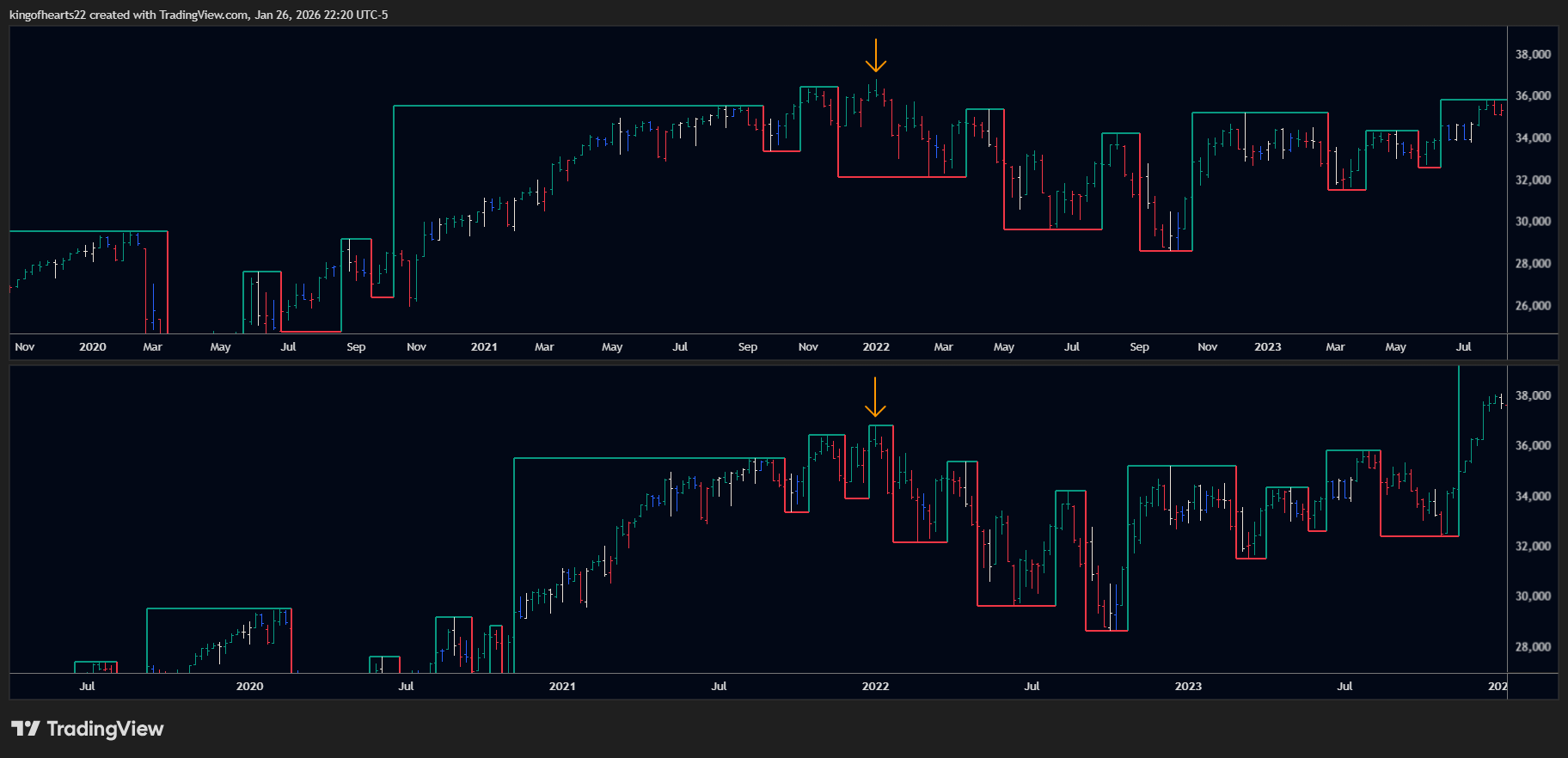

Example scenario (Period 3):

- Downtrend established with swing low at 100

- Market rallies: up bar, up bar (two consecutive)

- Third bar gaps up, makes new high at 115, but closes lower (not a third up bar)

- Market immediately resumes downtrend

Without Exception Rule: The rally to 115 is never recorded. Swing chart shows the low at 100 but misses the 115 high entirely.

With Exception Rule: The 115 high is captured as a swing high because it exceeded the prior swing high, even though only two (not three) consecutive up bars occurred.

At Period 3, this spike high is only captured with the Exception Rule enabled.

At Period 3, this spike high is only captured with the Exception Rule enabled.

Impact on Analysis

Missing swings means missing information:

Range Measurement: If a swing isn't marked, its range isn't measured. Your Pr/Px ratios, time calculations, and milestone projections all depend on accurate swing capture.

Support/Resistance: Unmarked extremes are invisible to S/R analysis. A significant high that's not recorded won't appear in your swing history.

Pattern Recognition: Swing patterns depend on the sequence of highs and lows. Missing swings can obscure or distort pattern formations.

The Exception Rule ensures your swing chart reflects what actually happened in price, not just what satisfied strict consecutive bar rules.

When to Enable

Recommended ON:

- Period 2 or higher

- Markets with frequent gaps or spikes

- When accurate range capture matters more than strict rule adherence

- Historical analysis where you need complete records

Consider OFF:

- Period 1 (rarely makes a difference)

- When you want the strictest possible mechanical interpretation

- Backtesting strategies that depend on exact rule definitions

For most users running Period 2 or Period 3 analysis, enabling Gann's Exception Rule produces more complete and useful swing charts.

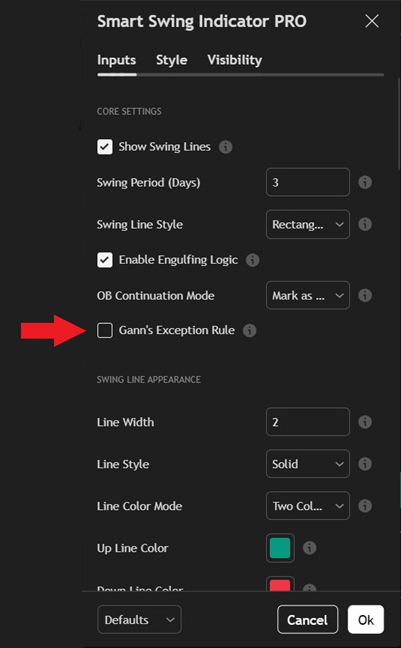

The Setting

Setting Name: Gann's Exception Rule

Location: Swing Detection section

Options: On / Off

Default: Off

When enabled, the indicator checks each bar against prior swing extremes and extends swings to capture ranges that would otherwise be missed.

Enable Gann's Exception Rule in the Swing Detection settings.

Enable Gann's Exception Rule in the Swing Detection settings.

Summary

Gann's Exception Rule captures price extremes that strict consecutive bar rules would miss:

- Part of Gann's original methodology, not a modern addition

- Most valuable at Period 2 and higher

- Ensures complete range capture for accurate analysis

- Recommended for most swing analysis use cases

The rule recognizes a simple truth: when price exceeds a prior extreme, that's meaningful information — regardless of how many consecutive bars it took to get there.